How to create an electronic exchanger. Business idea - open an exchanger of electronic currencies

exchanger electronic currencies can be "private" and "official". In this case, earnings come from each currency exchange operation, i.e. a certain percentage of the amount falls on the account of the exchanger as a commission (profit).

Today it is extremely difficult to enter the market as an official exchanger. And this is not a matter of technical problems (they can be overcome with the help of software). It is possible to provide wide coverage of currencies and automatic exchange, but significant barriers must be overcome. “Correctly agree! is the first barrier. Previously, it was possible to install a script, set up merchants and change money without official registration, but today it will not work. Since 2007, WebMoney has seriously tightened the rules. Competition is the second barrier. She's over the top here. In recent years, many offices have been opened, which after a while are closed.

Serious costs, both financial and time, will require the creation of an official exchanger. This option is suitable for large and serious companies and businessmen. The best option in currency exchange is the exchange in "rare" directions, which are not available on official exchangers with an adequate commission.

A "private" exchange is suitable not only for financial tycoons, but also for those who accumulate stocks of electronic currency, and they need a completely different one for turnover. Some make an exchange, while taking some percentage for themselves, others use the 1 to 1 rate, it is the absence of any commission that makes this option attractive to customers. In the case of official exchangers, everything happens automatically and there is a guarantee of reliability, but in the case of “private” there are no guarantees, except for an oral agreement and everything is done by hand.

But still, how to open an e-currency exchanger? The more cash reserves you have, the more exchange transactions will be carried out, and from each you will receive your percentage. If the volume of your activity is large, then the relevant authorities may be interested in you, then you will need to register an LLC and pay taxes.

What do you need to open an exchanger?

To open an exchanger, you need a script - an engine on which the exchanger will operate, which must be of high quality so that there are no malfunctions. The number of those who want to use your services will depend on advertising and authority, respectively, and your turnover. In the WebMoney system, the reflection of authority is called business level, which depends on the turnover of funds that has passed through the account and the more, the higher the authority. It is also possible to exchange electronic money for real money and vice versa, but first you should familiarize yourself with the tax legislation. If you are already familiar with the legislation, then open an electronic currency exchanger.

How to open an electronic currency exchanger?To create your own exchange office, you need to get personal certificate, then open your site and add it to the general official list. It should be noted that an office is not required for this type of activity. From two thousand dollars will be required to register an exchanger electronic money. It is also necessary to agree on joint cooperation with Internet banks and similar exchangers in order to have the possibility of a faster and more profitable exchange of funds. As an individual entrepreneur or individual, you can register for tax accounting. There are a lot of pitfalls in this area of activity, because this type of activity is not yet provided for by law.

We conclude an agreement with the services.

On the Internet, you can find many services that provide an exchange service. electronic means. However, anyone who wants to start working must conclude an agreement with payment systems, whose currencies he will operate. Such a document will clearly state what percentage the service must pay in favor of the electronic payment system. The exchange office independently sets the percentage that can be taken when exchanging electronic money. In this case, the percentage should be based on the current market conditions and the availability of a cash reserve. The exchange of electronic money, according to established traditions, is carried out at a commission equal to 1-5%. but newbie services don't start at the top. Only large players in this market segment can afford a 5% commission.

To create an exchange site, you need a good programmer,who will have to pay several thousand dollars in order to create a really high-quality exchanger with reliable protection from hackers. This is a rather expensive method, but it will save a lot of time. The programmer writes the script, creates the design, and this also includes hosting costs. However, if you decide to open an electronic money exchanger, then this business is quite profitable, and your income depends on the percentage you set and the popularity of your service.

Bitcoin is surrounded by uncertainty. Someone believes that the future belongs to him, while others are afraid - earn the cryptocurrency market to the fullest, it can destroy the world economy. But on both sides, people agree that today you can organize earnings on the exchange of bitcoins, get cryptocurrency for free or for elementary actions.

Earnings on Bitcoin: strategies

Essentially, Bitcoin is just a digital file where names and balances are recorded. These numbers have value because people have a desire to exchange goods and services for the coins of their balance in the wallet and are sure that others also think. Such a currency is valuable only because we see value in it. As, however, with any fiat currency issued by the state. Or is there still someone who still believes that dollars are backed by US gold reserves?

In any case, today it is easy to make money on the bitcoin exchange or faucets.

Getting free satoshi and bitcoin - faucets

You can earn cryptocurrency for free or for simple actions. For example, visiting a website, watching a commercial, or completing a survey. There are sites that distribute Satoshi - fractional parts bitcoin (in 1 btc 100 million satoshi).

On some sites, in order to receive cryptocurrency, you need to solve a captcha or perform an action, usually of an entertaining nature, such as spinning a roulette wheel. Faucets are numerous, and distributions of bitcoins on the Internet occur very often (every five minutes - a day), but there is a drawback: in order to earn some small amount, you will have to constantly be at the computer.

We will not explain for a long time about taps, since it has already been written.

Cloud mining and investments in it

The real gold mine of cryptocurrencies is cloud mining("prey" in translation from English). Each coin is a programmed code digital recording in the registry, so that you can generate cryptocurrency on . So, money is obtained literally from thin air. But the technique for really profitable mining is very expensive.

Earnings on the cryptocurrency exchange

Earnings on the exchange of bitcoins does not require such large investments as mining, the system is simpler, can be controlled independently and without highly specialized knowledge. Firstly, you can buy cryptocurrency and hold it until the rate rises, but this way of earning money requires significant investments. Secondly, it is possible to make money on the exchange of bitcoins through exchangers or exchanges. The latter option allows you to receive money quickly and does not require large investments.

The essence of obtaining income on the exchange

Engaging in currency exchange has always been profitable. The essence of making money on the Bitcoin exchange is extremely simple: the cryptocurrency is bought at one rate, and sold in a different way, as a result, a profit is made. In different cities and countries (even in different exchange offices in the same city), exchange rates can differ significantly, to say nothing of the Internet with all sorts of payment systems.

Earnings on the exchange of bitcoins: step by step instructions

Earnings on the exchange of bitcoins: step by step instructions

What do you need to organize earnings on the Bitcoin exchange? Need to register online wallet in Qiwi or Yandex.Money and . You will also need a small initial capital. As a rule, 1500-2500 rubles are enough to start. You can start with a smaller amount, but then the strategy will be a little different, you will have to use the help of monitoring, because not all sites work with small amounts.

Method for investments from 1500–2000 rubles

How to make money on bitcoin exchange? In the general case (with an initial investment of 1500–2500 rubles or more) step-by-step instruction income looks like this:

- Register in your chosen payment system and replenish Qiwi or Yandex wallet. You can also use WebMoney or any other electronic currency, but then you have to look for sites - exchangers that work with WMR.

- Exchange rubles for bitcoins in any of the exchangers. You should choose a reliable service, first you need to read the reviews, the minimum amount for the exchange, the conditions.

- The received bitcoins can be exchanged back for rubles. This can be done even through another exchange or exchanger, you need to see how it will be more profitable. The money will be in your account in a few minutes.

On one such exchange cycle, earnings can be 15–20% of the amount of initial capital, so making money on the bitcoin exchange is simple and profitable. For example, with investments of 2000-3000 rubles, the net profit will be from 200 to 600 rubles. The cycle can be repeated many times, and in the future, the initial bet can be increased to 6,000 rubles or more. At the same time, profits will also increase significantly.

How to make money with minimal investment

Even if the initial capital is less than 2 thousand rubles, earnings on the Internet are bitcoin exchange is still possible. You just have to pay special attention to the choice of sites - exchangers. You can view the best offers to start making money on the bitcoin exchange on Bestchange - a service designed to monitor profitable exchange offers. For example, on the Kassa website minimum amount exchange is 150 r.

Possible Difficulties and Warnings

In addition, before carrying out the exchange cycle, you need to calculate how profitable it is in this moment time. The cryptocurrency market is very young, so the rate can be subject to strong fluctuations. If you take into account all these factors, then you can really get a good income on the exchange of bitcoins.

Interesting news? See also in Telegram. Follow us on social networks: Twitter, Google+, Instagram, Facebook. Subscribe. If you liked the article, share it with your friends, on forums, in social networks. networks - it's not difficult for you 🙂 and you will help us to develop the project faster.

Currency exchange has always been considered a very profitable business. To be convinced of this, it is enough to look at the number of "underground" changers in the markets. And the number of exchange points is growing exponentially.

The history of currency exchangers dates back to the times of the USSR, when all transactions with currency took place under great secrecy, and for illegal transactions with "overseas" money one could go to jail. Immediately after the collapse of the Union, the exchange business was legalized, because most of the citizens of the Russian Federation got the opportunity to travel outside the country. In order not to waste time and nerves on exchanging funds abroad, many residents of the Russian Federation tried to change money before leaving. The currency has also become popular as a store of value. We all know the result - increased demand led to the emergence of the first exchange offices.

Functions, pros and cons of the exchange office

Modern exchange offices conduct the following activities :

Buy foreign currency from individuals (non-residents and residents);

- carry out the sale of foreign currency to individuals (as a rule, residents);

- carry out a reverse exchange of currency from national to foreign (for individuals- non-residents subject to established rules and regulations;

- carry out converted transactions with foreign currency;

- exchange banknotes of the monetary unit of one country.

Advantages of opening a currency exchange office:

Fast payback;

- maximum simplicity from a technical and organizational point of view;

- the possibility of expanding activities and increasing profits by opening new currency exchange points.

Cons of opening a currency exchange office:

Large investments, which are caused by the need to draw up documents and organize reliable protection of the exchange office;

- high level of competition (especially in big cities);

- Difficulties in finding a prominent and profitable place to open a business.

The main risks of opening an exchange office:

High risk of theft of funds by staff;

- the probability of loss of a license due to violation of the conditions of activity;

- the risk of robbery due to the low level of security (which is why it is not recommended to save on this aspect);

- frequent checks by the representative of the Central Bank and the Economic Crime Department.

How to arrange a currency exchange office?

The main snag of this type of business is registration. According to the laws of the Russian Federation, only a bank (credit organization) has the right to organize an exchange office. The procedure for opening such a business is carried out taking into account two documents:

The main snag of this type of business is registration. According to the laws of the Russian Federation, only a bank (credit organization) has the right to organize an exchange office. The procedure for opening such a business is carried out taking into account two documents:

Federal Law of Russia "On the Central Bank of the Russian Federation";

- Federal Law of Russia "On currency regulation and currency control".

Thus, the Central Bank of the Russian Federation independently regulates the processes of opening currency exchange offices, completing their activities, organizing work, as well as the list of permissible operations and other transactions using national and foreign currencies with the participation of individuals.

An individual has access to this type of business only if the employment relationship with the financial and credit structure is formalized. Banks that have the right to open exchange offices issue licenses to individuals. After that, newly minted entrepreneurs have the right to open a currency exchange office. The advantage is that the issuance of licenses has recently been available even to small banking institutions.

How to act? To start an exchange business, you need to get a job in a banking institution and take the position of a manager or manager of a currency exchange office. Next, an application is submitted to a banking institution to open an exchange office. Here you will need the following documents:

Employment agreement with a banking institution;

An agreement confirming the fact of opening an exchange office;

- a list of the bank's requirements for its partner (implementation of the instructions of the Central Bank of the Russian Federation, timely reporting, payment of commissions once a month, and so on).

In turn, the entrepreneur takes on the following issues :

Finding a suitable office for an exchange office and arranging its lease;

- selection of equipment for the premises and its installation;

- Finding suitable employees and resolving questions about their employment.

In practice, the relationship between a banking institution and the owner of an exchange office can be organized in different ways. For example, the bank itself can search for premises and sublease them. At the same time, the owner of the exchanger once a month makes payments for collection, packaging of cash, their recalculation, software maintenance, and so on. Total payments can be 40-60 thousand rubles. In addition, you will have to transfer 50-60 thousand rubles to the bank for servicing the cash desk.

During the period of activity of the exchange office, the partner bank is engaged in the formation of reports, making tax payments, and so on. If the owner has violated the requirements of the agreement, the bank has the right to close the exchange office, informing the Central Bank of the Russian Federation about this. If the bank itself had problems (for example, it was deprived of its license), then it is not necessary to close the exchanger - you can contact another banking institution.

How to choose a room for a currency exchange office?

The exchange office is best placed in a crowded place where there will always be customers. For example, it can be a train station, bus station, business district, market, and so on. The exchange process itself largely depends on the location of the point. For example, if an exchange office is open in a residential area, then a popular conversion will be an exchange from the ruble to a foreign currency. If the exchanger is placed in a shopping business center, then the process will be reversed.

When choosing a place for a room, you should focus on the presence of competitors in the nearest areas, their exchange rates and popularity. If there are other exchange offices in the area, it is easier to find out which currency is most in demand, what to focus on at first. If the rate of a particular currency in an existing exchanger is too high, then the proposed currency is simply not in demand.

After choosing an office, a lease is issued. Acts as tenant entity partner bank. To conduct normal activities, the area of the exchange office should be from 6 thousand square meters or more. Mandatory requirements - the presence of an armored door, the same windows and walls. Fire and burglar alarms should also be organized. Ready-made booths can be sold ready-made - their price is from 150 thousand rubles and more.

What equipment to buy for an exchange office?

The main equipment, without which you can not do even at first, include:

The main equipment, without which you can not do even at first, include:

Currency detectors (check cash for counterfeit);

- safes (for storing money);

- cash counters;

- a computer with software whose task is to control the movement of money. As a rule, the supervising bank acts as a software supplier.

It is important to take into account a number of requirements of the Bank of Russia, according to which the booth of the exchange office should have:

Information regarding the phone number and address of the authorized banking institution that opened the exchange office;

Data on the exchange rates of those currencies, the exchange of which is possible at a given time;

List of operations that can be performed by the exchange office (with currency and national money);

Exchange office hours. As a rule, the duration of the exchange office coincides with the working hours of the banking institution (operational day). There are exchange offices that work around the clock;

An extract, which shows the commissions to the partner bank for conducting cash transactions;

Standard book for the consumer, where you can leave your complaints and suggestions;

Rules for the exchange (acceptance) of damaged banknotes and other documents.

How many staff will be needed to operate the exchange office?

Two cashiers are enough for one exchange office. Work schedule - a day in a day or two in two. At the same time, it will not be possible to directly register new employees at a currency exchange office. All employees must take a formal position as a manager of an exchange office or a bank teller.

The main problem of all exchange offices is theft by the staff. When a client hands over any money in foreign currency, the cashier can keep the difference from the exchange. As practice shows, there is little trust in this type of business. So at first, the ideal cashier is the owner himself. But, of course, it won't last long.

An important issue is the control of cashiers, who work 12-18 hours and pass through themselves large cash flows. This can be done in two ways:

Install a video surveillance system;

- make test purchases.

In practice, both options mentioned above do not work well, because it is impossible to watch 12-18 hours of video, and it is a very difficult task to convict a neat cashier of cheating. It is easier to set a limit on the daily income that an employee must hand over. The rest is his income. To determine the average amount of daily revenue, the owner himself takes the place of the cashier and works for several days.

Profit of the currency exchange office

The main income of the exchange office is the spread (the difference between the sale and purchase of currency). In addition to this amount, the exchange office may set additional commissions. As for the rates, the exchanger sets them independently, taking into account the current supply / demand. At the same time, for normal operation, the cash desk of the point must have cash for the purchase and sale of various currencies.

The main income of the exchange office is the spread (the difference between the sale and purchase of currency). In addition to this amount, the exchange office may set additional commissions. As for the rates, the exchanger sets them independently, taking into account the current supply / demand. At the same time, for normal operation, the cash desk of the point must have cash for the purchase and sale of various currencies.

The bank administration has the right to control the work of the exchange office and make adjustments to its activities. When deviating from the rules, the bank may issue a warning or even close the item.

With proper business organization, the annual earnings of an exchange office can reach 3-3.6 million rubles. All this money is the owner's net income. They must be at the exchange office and cannot be collected.

Who checks the currency exchange office?

The owners of exchange offices need to be afraid of three main instances:

TSB RF;

- OBEP (department for combating economic crimes);

- tax service.

Most often, the inspection is carried out on the first day of activity. The focus is on compliance with all rules and regulations (mentioned above), the presence of panic buttons, reliability, alert functions and the presence of an alarm.

The risks associated with inspections by the Central Bank and the OBEP can be reduced. All that is required for this is to conduct honest business, avoid fraudulent transactions, and clearly declare the exchange rate. If you comply with all the requirements of the OBEP, then there will be no problems with the partner bank and the Central Bank. The downside is that doing business honestly inevitably leads to additional costs. On average, this is 5% and plus taxes on income reflected in the documents.

How much money is needed to open a currency exchange office?

When organizing such a business, there are two main types of costs:

When organizing such a business, there are two main types of costs:

1. One-time expenses:

Purchase of equipment (safe, PC, software, telephone line, detector and so on) - from 200 thousand rubles;

- organization of a booth for work - from 250 thousand rubles;

- installation of video surveillance, alarms, ACS (access control systems) - from 150 thousand rubles;

- personal funds for turnover - from 1.2 million rubles.

Total - from 1.8 million rubles.

2. Monthly expenses:

Commission to the bank-curator - from 50 thousand rubles;

- rent for the premises - from 30 thousand rubles;

- salary of two cashiers with taxes - from 30 thousand rubles;

- payment for security services - from 50 thousand rubles.

Total - from 160 thousand rubles.

With an average monthly income of 250-300 thousand rubles, the costs of organizing an exchange office can be recouped within a year.

Stay up to date with all important United Traders events - subscribe to our

There are more than enough ideas for business, but first of all, you need to consider options related to current trends. Now at the peak of the popularity of cryptocurrency.

Many open farms for the extraction of altcoins, there is an alternative and very interesting option to launch a project, providing services in demand.

How to open a cryptocurrency exchange? Anyone who has already understood how high the turnover of these assets is, knows that this is a gold mine. Users change coins for billions of dollars every day.

Even if you get 0.0001% from these operations, there will be a good profit. Just don't jump to conclusions it's not easy to start something like this.

Open a cryptocurrency exchange as a business

The idea itself is very promising and profitable. Now the crypto market is very popular, and numerous transactions are the potential income of intermediaries. It is impossible to use altcoins without them, so the owners of exchangers and cryptocurrency exchanges are raking in money with a shovel.

You can scale such a business as much as you like, increasing reserves, connecting new exchange directions, providing loyalty programs, and so on. It will be much better if your exchanger supports not only cryptocurrencies, but also fiat money.

This is more difficult to implement, but otherwise demand for services is unlikely to be high.

In order to promote quickly and effectively, you will need to set courses in such a way that they remain attractive to customers and at the same time bring income to the creator.

Finding this edge is not easy, you need to know in advance where it is more profitable to make a deal in the future, to sell the received coins (or buy them to replenish reserves).

The main difficulty for most novice businessmen is start-up capital.

To run a high-quality exchanger, you need a lot of money. It is necessary to provide a worthy reserve, and in several currencies at once. And if people change small amounts, then the commission from operations will be minimal.

How do exchange offices work?

It is surprising that some newbies try to get into this topic without even understanding the basics. They don't know how exactly exchangers work. In general, nothing complicated, but you need to decide in advance which mode will be used:

- Manual- the client creates an application, the operator processes it and provides details for the transfer. After receiving the funds, the exchange currency is manually sent to the client's account.

- semi-automatic This mode has two types. Firstly, after receiving the application, the operator only checks the data and approves the execution of the operation. Secondly, small transactions can be carried out automatically, and when large amounts are exchanged, the operator connects and conducts them manually.

- Auto- all transactions are automated, the client submits data, the application is instantly processed and the algorithm checks the receipt of funds, and then sends them from another wallet.

In the first couple, it is better to use manual mode, slowly, but definitely without failures. You will have to spend personal time and process transactions.

If there is a competent programmer, then you can immediately set everything to automatic, but be prepared for various nuances (for example, when one client exhausts all reserves).

Pros and cons of cryptocurrency exchanges

When opening any kind of business, you need to evaluate the idea and consider it from all sides. Digital money exchange services are now in demand, but there are other projects besides exchange offices.

Cryptocurrency exchanges, wallets with built-in exchange, other services. Why do people choose exchangers?

- with their help, it is easiest to exchange electronic money and cryptocurrencies;

- on some exchangers cash transfers are available;

- you can even use the codes of the cryptocurrency exchange for exchange;

- to make an exchange, you don’t even need to register;

- instant exchange operation;

- receive discounts and bonuses for activity.

For each of these areas, you need to work separately so that your exchanger does not lag behind competitors. And to make it even better Popular bugs need to be fixed:

- a small selection of exchange directions;

- small reserves (you will not exchange a large amount);

- in manual mode, the exchanger does not always work;

- overvalued or undervalued exchange rate (not profitable);

- low level of security.

Here is a list of things to work on. Improve reputation, provide guarantees, connect more currencies, automate transactions and offer impressive reserves.

Some users evaluate exchangers precisely by how much money they have in circulation.

Instructions - how to open an online cryptocurrency exchanger

To open such a serious business as a cryptocurrency exchange, you need to perform a lot of actions. First of all, you need to study the theory, read forums, similar articles and learn something. Only when you get some knowledge, start acting:

- Search for start-up capital.

The cost of developing a site, buying a script, domain, hosting, server - all these are trifles, compared to how much money you need to add to the reserves.

Without a large margin, it will be impossible to carry out many operations, and users will not wait for you to get promoted, they need everything at once. Therefore, beginners rarely apply this idea, and we will talk about how much money it takes separately.

- Company formation.

Cryptocurrencies are not regulated by Russian law, so you can start without official registration.

However, other electronic money that you plan to connect falls under the law. It will definitely not be superfluous to immediately solve this problem, one of the options:

- Japanese license- costs a lot of money (maybe more than $ 100,000), more suitable for those who plan to launch cryptocurrency exchanges.

- Registration of IP– you register a company in the field information technologies and legally provide cryptocurrency exchange services. True, with the advent of new laws, difficulties may arise.

- Perpetual loan agreement- this is how most exchange offices work. Such an agreement does not require notarization, but it is better to draw it up with a competent lawyer.

Project organizers on the Internet do not always work within the law, and as long as the money is small, this is not necessary. However, the creation of a cryptocurrency exchange involves the use of a large volume Money, therefore, it is better not to hesitate with the design of "paperwork".

- Site launch.

The site must be of high quality, so there is little trust in exchangers, especially new ones. Therefore, it needs to be tested, worked out every little thing, made an excellent design and user-friendly interface.

As for hosting and domain, everything is obvious here, you can’t skimp, buy a dedicated server and a beautiful name for a reputable exchange office. We will also talk about the development of such sites separately, there are several options for creating them.

- Unrolling the exchanger.

The competition in this niche is serious, it will be difficult to break through. Allocate part of the budget for advertising and be sure to add the service to popular monitoring - BestChange and KursExpert.

The influx of customers, and, accordingly, the company's income, depends on how effectively the marketing campaign is carried out. It is not enough to make a high-quality website, you also need to show it to a large audience.

This is a simple plan of action, but you will need to complete more steps. We have combined everything into 4 points so that you have general idea and knew what to work with. Looking ahead, think several times whether it is worth implementing such an idea at all.

The subtleties of business on the exchange of cryptocurrencies

All the nuances are related to the regulation of altcoins. Now various bills are already being prepared in Russia, some politicians are in favor of banning cryptocurrencies, because they untie the hands of scammers, have no real value and high risks for those who invest in them.

A number of countries already have laws on cryptocurrencies. In the USA it is forbidden to invest in ICO, in Vietnam, Kyrgyzstan, Indonesia it is generally forbidden to use altcoins. Who knows what our government will do.

Of course, they will not be able to completely cut off the oxygen, because blockchains are decentralized, but they will not be able to work in the legal field.

Therefore, for businessmen there are additional risks. Yes, now there are no difficulties, you register as an individual entrepreneur and pay the usual taxes, like other companies. But you always need to calculate everything in advance.

Is it easy to create a cryptocurrency exchange?

Exchange sites look simple, some of them are one-page. But they contain algorithms that help automate operations, and this moment requires increased attention.

After all, there is a risk of becoming a victim of hackers. Development of the necessary software is possible in one of these ways:

You need to be sure that not only well-written code is used, but security remains at a high level. That is why it is hardly possible to do without a professional in the team. You can find it by creating a vacancy on one of the freelance exchanges.

How much money do you need to open a cryptocurrency exchange?

In this article, we have repeatedly talked about start-up capital and how large it should be. The topic is serious, you will have to invest in a big way. Let's put aside the development of the site, only you will have to spend thousands of rubles monthly on advertising.

Someone fits into the budget up to 10,000 rubles, but in order to effectively promote the project, you need to invest from 100,000 rubles.

The main expense column is the replenishment of reserves. To make exchanges, you need to buy a lot of different currencies. The more destinations are offered, the more you will have to invest.

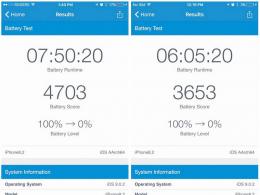

To give you an idea of how much we are talking about, just look at the reserves of the most popular exchangers:

At least $ 30,000, and at the current rate it is 2 million rubles. There are also more solid projects, where the turnover is 1.85 million dollars, which is 124 million rubles.

Of course, you can get by at least 300,000 rubles at the start, but you will have to constantly keep them in circulation and not count on a quick income.

Is it worth creating your own cryptocurrency exchange on the Internet?

The idea of opening a cryptocurrency exchange as a business is a great option. It’s really possible to earn big money on this, especially since a huge audience uses the services of such services. But first you need to take into account all the nuances, is this business right for you?

Not everyone can develop a high-quality and safe site, and besides, large investments are required.

If you are on fire with the idea and are ready to invest substantial amounts, then in conclusion we will present the key factors for the success of exchangers:

- impeccable reputation, customer support and responsive support;

- profitable courses, loyalty programs, bonuses for active customers;

- the presence of an exchanger in popular monitoring and catalogs;

- profitable affiliate program;

- relevance of connected cryptocurrencies and other electronic money;

- ease of use of the exchanger, quality of design;

- the speed of processing applications;

- sufficient reserves for large exchanges.

For many entrepreneurs, it all starts with private exchanges. They offer people an exchange in person, through guarantors, without commission. Perhaps you should also try to do this at the start. The main thing is to think about everything in terms of security.

We will not dissuade those to whom the idea of creating a cryptocurrency exchanger seems ideal. It's really good, but it's hard to implement such a project.

Start by looking for partners, the team will definitely need a competent programmer and marketer, whole teams of employees worked on the development of some exchange offices.

I recommend visiting the following pages:

—

—

—