Virtual currencies list. Bitcoin virtual money, what is it, advantages, disadvantages

Debit payment schemes are built similarly to conventional cash and check schemes.

"Electronic money"completely simulate real money. The organization that manages the payment system - the issuer - issues some electronic analogues of money, called differently in different systems (for example, coupons). They are bought by users who use them to pay for purchases, and then the seller repays them both banks and non-bank organizations can issue electronic cash.

- still not developed one system converting different types electronic money. Therefore, only the issuers themselves can redeem the electronic cash issued by them; in practice, "exchange offices" are used, independent of the systems themselves. For example, funds can be transferred from the Yandex.Money system to the WebMoney system only through third-party sites.

- the use of such money from non-financial structures is not guaranteed by the state.

However, the low transaction cost makes e-cash an attractive tool for online payments.

Electronic checks are analogous to ordinary paper checks. These are the instructions of the payer to his bank to transfer money from his account to the account of the payee or to issue them to the bearer of the check. The difference from paper checks is that:

- firstly, when writing a paper check, the payer puts his real signature, and in the online version - an electronic signature;

- secondly, the checks themselves are issued in in electronic format.

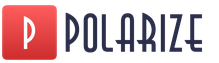

Payment card processing

Internet credit systems are analogous to conventional systems that work with credit and debit cards. The difference lies in the conduct of all transactions via the Internet. In addition, a distinction should be made between virtual debit cards issued by some banks and real credit and debit cards. Prepaid virtual debit cards are a complete analogue of a regular Visa or similar card that is accepted on the Internet. The difference is that the card is not printed in plastic. The owner is informed of all the payment details of such a card and, from the point of view of an outside observer, the payment is made from a regular plastic card. Such a card is easier to buy, since the issuance of such a card is carried out without verifying the identity of the owner. On the other hand, such cards, as a rule, do not provide for the possibility of replenishing the account.

Links

Wikimedia Foundation. 2010 .

See what "Virtual money" is in other dictionaries:

Contents 1 Economics 2 Cinema 3 Theater 4 Computer games ... Wikipedia

Virtual currencies and virtual exchanges in the world- Recently, the so-called virtual currencies have received a certain distribution in the world. The popularity of any virtual currency is determined primarily by the instantaneous closing of transactions with it, as well as the so-called network external ... ... Encyclopedia of newsmakers

Intangible objects that are purchased by users of social networks, virtual worlds and online games. Virtual goods can only be used in a specific virtual environment, and therefore have no material value in ... ... Wikipedia

Electronic money- (Electronic money) Electronic money is the financial obligations of the issuer in electronic form Everything you need to know about electronic money history and development of electronic money, transfer, exchange and withdrawal of electronic money in various payment systems ... Encyclopedia of the investor

Yandex money- (Yandex money) Yandex.Money is the world electronic payment system Yandex Money payment system: registration, opening a wallet, replenishment and withdrawal of funds Contents >>>>>>>>>> Yandex.Money is defined ... Encyclopedia of the investor

Type of CJSC Year of foundation 2009 Location ... Wikipedia

Or the game currency is non-fiat electronic money that is used to purchase and sell virtual goods in various online communities: in social networks, virtual worlds and online games. In every environment, a virtual currency ... ... Wikipedia

About the movie Point Blank, see Shot at point-blank range (film) Point Blank The unofficial symbol of Point Blank in the Russian Federation Developer Zepetto Publishers ... Wikipedia

Investor- (Investor) An investor is a person or organization that invests capital for the purpose of making a profit Definition of the concept of investor, private, qualified and institutional investor, features of the investor's work, well-known investors, ... ... Encyclopedia of the investor

This article lacks links to sources of information. Information must be verifiable, otherwise it may be questioned and removed. You can ... Wikipedia

Books

- , Julian Dibbell. This book tells about a new cultural phenomenon that is just penetrating into the public consciousness. Massively multiplayer online games like Ultima Online or EverQuest, in…

- A million playfully. How I Became a Millionaire Trading Virtual Treasures and Laundering Money from Virtual Worlds in Online Games by Julian Dibbell. This book tells about a new cultural phenomenon that is just penetrating into the public consciousness. Massively multiplayer online games like Ultima Online or EverQuest, in…

Since the advent of virtual money, which was considered exclusively game currency for the corresponding software, a lot has changed. People seeking anonymity, privacy, have been tirelessly looking for ways to make encrypted payments. This meant hiding both the participants in the exchange and the very fact of transactions.

Research was carried out in several directions at once. Since 1992, cryptography has become the subject of study by specialists seeking to ensure the confidentiality of communication in general. During this period of time, the first cryptophones appeared, messengers with a special encryption method began to be developed. By 1998, one of the fundamental concepts was formulated, following which: there was a way to make payments between anonymous users.

In parallel with this, new payment systems developed, along with electronic money. But the defined structure kept in touch with the bank. Then, as the goal of "anonymous" was to achieve not only confidentiality, but also the ability to safely make payments, bypassing the public financial sector. After the invention of the "blind signature" by David Chaumu in 2003, the process accelerated. In 2008, the global financial crisis allowed the emergence of a digital currency - bitcoin.

The direction developed quite quickly, as a result, it became obvious that the emerging monetary unit of the Internet would not be alone for long. There are already alternative cryptocurrencies. Some of them even managed to compromise. This is Ethereum, fragment open source which has been replaced. Subsequently, the planned emergence of new platforms with a huge number of startups remained to work at The Dao. But alternatively, Ethereum Classic continues to function.

Popularity of new money: parameters for comparison

It seems necessary to note a few important points:

- cryptocurrency keeps the accumulation of money as a priority, but not their use for mutual settlements;

- varieties of virtual funds do not have the goal of crowding out alternative solutions;

- the weakening of the network effect, which was obvious in the early stages of existence.

At the same time, the situation is changing rapidly, for some six months, bitcoin managed to make dozens of ascents and no less falls. But the increase in the nominal price was more convincing than its decrease. Low predictability and the possibility of a sharp collapse should probably already be attributed to the obvious disadvantages of cryptocurrencies. Meanwhile, bitcoin retains an undeniably leading position among similar money produced on the basis of blockchain technology. This is expressed by capitalization. Bitcoin is dozens of times ahead of its closest “competitors”: Ethereum and Litecoin.

However, the final comparison of popularity takes place according to parameters that are somewhat unusual for ordinary people. Among them, for example, are:

- the number of nodes (nodes) of the system;

- number of transactions per day;

- registration of new users.

In terms of the number of transactions, the platform is ahead, which in terms of the amount of capitalization is not even among the top three - Ripple. The second is occupied by bitcoin, the third by The Dao. Only 3% of all operations within the systems are taken over by other platforms.

Signs of cryptocurrencies

Digital money produced or sold on the basis of blockchains is analyzed by banking structures. The main features of cryptocurrencies include the following:

Digital money produced or sold on the basis of blockchains is analyzed by banking structures. The main features of cryptocurrencies include the following:

- possession of monetary properties (accumulation, use as payment);

- detachment from the central government of all states, not subject to specific institutions;

- non-banking nature of development and circulation.

Several banks at once define cryptocurrencies as something that has value and can be used alternatively to money. Going deeper into quoting various sources does not give any changes, but allows you to more finely grade cryptocurrencies. Additionally, feel the difference between other types of virtual, electronic and fiat money.

An important difference between cryptocurrencies and digital money is the decentralized management of funds produced on the basis of blockchain technologies. Then, as the existence of digital money with centralized management, remains a reality. Users have to grasp this fine line between the two.

For some clarity, we note that a convertible virtual currency can be either centralized or not. But non-convertible can only be managed by an administrator or other regulatory body. Nothing to the contrary is yet known.

Out of all informational citation, the description provided by the OECD stands out. The authors, in addition to much already listed, highlight the fact that blockchain technology controls the sale process. Thus, the same unit (or part of it) will not be sold to two or more users at the same time. However, the name of the seller remains anonymous.

Remain open questions on the issue of new money. They can be produced by users through a complex algorithm, cryptographic replaces the trust in the emitter of funds. This approach preserves decentralization. The units produced are dependent on the power used by the machines.

The following questions are also fundamental:

- code openness;

- availability of its study for all participants of the private market;

- maintaining the principle of equality between users of one system;

- bitcoin (or other similar currency) may be a means of payment, but has no legal status.

But all of the above, and especially last paragraph, indirectly or directly says that the "new" currency does not yet have a specific meaning. So far, when talking about it, comparative characteristics are more often used, tending to combine 2-3, and sometimes more concepts.

This is confirmed by the systematic recognition of cryptocurrencies. In Japan it is digital money, for Americans it is securities. However, none of the countries managed to bring bitcoins and similar monetary units under the legislative base.

Deeper differences between cryptocurrency and electronic money

The fundamental difference lies in the methods and subject of emission. Cryptocurrency is produced directly by the user with a predetermined volume and name (bitcoin, ethereum, etc.). It is important that the bank does not do this, the unit is divided into shares. Electronic money is issued not as such, but in the currency of the state that controls a particular payment system.

The fundamental difference lies in the methods and subject of emission. Cryptocurrency is produced directly by the user with a predetermined volume and name (bitcoin, ethereum, etc.). It is important that the bank does not do this, the unit is divided into shares. Electronic money is issued not as such, but in the currency of the state that controls a particular payment system.

Next important parameter possibility of making payments. Here, the comparison is not in favor of cryptocurrencies, since a preliminary exchange for fiat money is required. Electronic analogy allows you to pay without additional transactions within the framework of many selling projects: shops, ticket offices, hotel reservations, cars, etc.

A significant difference can be traced in a number of ways, including the following:

- personification;

- availability of viewing operations;

- quotation;

- transfer of funds (within the network or to personal accounts of other payment systems);

- degree of protection (possibility of risky operations);

- the height of commissions for transactions;

- other.

Despite all these differences, some analysts draw parallels that make electronic and virtual money similar:

- a) the realized desire of market participants to use cryptocurrencies for making payments or savings;

- b) users of one network recognize the developed settlement mechanism;

- c) striving to achieve validity.

However, the embodiment of the desired is realized differently, different financial institutions and instruments are involved. Electronic and virtual money through transactions allow you to pay for goods through transactions, bypassing the direct exchange of money.

But in the first case, the process is regulated by some financial institution with full set related services. It implies a staff, specialized equipment ( cash registers, acquirers, etc.).

Cryptocurrencies are not centrally controlled. With electronic money, payments are made to the address of the operator. For a virtual analogue, one is either not identified, more often it is absent altogether. The operator is replaced by exchanges, commercial platforms, exchange offices.

Well, and the final difference, which is considered especially frightening:

- the cost of electronic money is equal to the national currency, provided by law;

- the price of bitcoins and derivatives is the equivalent of the nominated unit in another currency unit.

Many features of cryptocurrencies cause simultaneous interest and wariness. The desire for anonymity, attempts to make the circulation of currency liquid only within closed financial "ecosystems", give rise to talk about the legality of using virtual money.

Already today, within the framework of the existing Fintechs, an almost political event took place in relation to cryptocurrencies. Visa and Mastercard were excluded from the newly created system due to their foreign origin.

Virtual money bitcoin – it first cryptocurrency, electronic facilities that created no one famous programmer(or a group of programmers) under the pseudonym Satoshi Nakamoto. It happened in 2009. The term "Bitcoin" and the specifics (Bitcoin's algorithm) were invented by him.

If in real life, we have to use one or another currency, depending on the country of residence, then no one forced Internet users to pay with Bitcoin, much less forced. Virtual money is the free choice of free people. You can buy the most stable cryptocurrency for rubles.

How Bitcoin virtual money works

Each network member can make instant transactions with virtual money without intermediaries. That is, the buyer transfers money directly to the seller. No need to go to the bank or deposit money into a Qiwi wallet, you just send Bitcoins to a person. The coins in the system are cryptographic (mathematical) hash codes. Each one is completely unique and cannot be used twice.

Like any currency, Bitcoin has its own exchange rate. You can check the current cryptocurrency rate on the blockchain.info website.

Bitcoin mining what is it? New Bitcoins or any other cryptocurrency are created through a process called mining.

The essence of Bitcoin mining comes down to solving some complex crypto problem, which is solved by brute force. So regular computer not suitable for these tasks. Typically, cryptocurrency miners use ultra-performing PCs or powerful servers.

But as the Bitcoin network grows at an unprecedented pace, mining has become a technologically complex process.

Alternative ways to get Bitcoin cryptocurrency:

- As payment for the services and goods provided;

- Purchase of Bitcoin cryptocurrency;

- Bitcoin exchange between individuals.

I can only highlight the 2 most suitable options for acquiring Bitcoin virtual money: for the Russian Federation, this is the Matbi exchanger, and for the rest of the CIS countries, buying Bitcoin through the WebMoney exchange.

Disadvantages of virtual money Bitcoin

I consider the main and only drawback of Bitcoin to be the still strong influence of news on virtual money. Almost all the ups and downs of the Bitcoin exchange rate directly depended on the announced statements of the governments of different countries. High exchange rate volatility creates problems in the short term. For example, you bought Bitcoin, and in a month it fell by 10%. The exact opposite can also happen.

But, on the other hand, if the Bitcoin rate more or less stabilizes and becomes less volatile, then investment potential of cryptocurrency will decrease very much.

Virtual money: how can it be used?

Bitcoin can be used to buy goods and services online anonymously. In addition, making international payments is easy and cheap because Bitcoin is not tied to a specific country.

There are several options for storing Bitcoins:

- Offline wallet

It is installed and created on your PC. It is usually encrypted to avoid being hacked.

However, there are some disadvantages here, if you forget the password to enter the wallet or the computer crashes HDD You will permanently lose access to your funds. - Online wallet

An online Bitcoin wallet has its advantages over the offline version. You can access it using not only a PC, but also a tablet or phone. The specifics are similar to ordinary Qiwi wallets, WebMoney or Internet banking. One of the main problems of these wallets is that all data is stored on the server. If the server is hacked, then all the information will be hacked.

Bitcoin (bitcoin) is an intangible digital currency and a special type of payment system. This money cannot be held in your hands, but you can pay with it by making purchases in online stores. The transfer of bitcoins from user to user is the transfer of encrypted data.

This cryptocurrency is based on two qualities - absolute anonymity and reliability of intrasystem transactions.

Bitcoin (BTC) is not associated with banks, states, gold reserves, as it is only a set of symbols obtained as a result of solving a problem. As conceived by the creator, only demand, which is deliberately limited, can influence its course.

According to the created algorithm, the number of BTC cannot exceed 21 million units. Virtual coins appear gradually, and the process of their emission should approximately end in 2140. The basic principle of the existence of this currency is the constant calculation of the encrypted function.

A user who decides to create new bitcoins sets a special software to your computer. The ultimate goal of numerous calculations is the creation of a decentralized free currency. This process was called "mining" (mining - mining). Mining is based on a cryptographic algorithm that converts data into a bit string.

A user who decides to create new bitcoins sets a special software to your computer. The ultimate goal of numerous calculations is the creation of a decentralized free currency. This process was called "mining" (mining - mining). Mining is based on a cryptographic algorithm that converts data into a bit string.

Attitude towards bitcoin in different countries

Does the cryptocurrency have a chance to be in circulation along with real currencies or can it be treated as a game? There is no definite answer to this question yet. Most economists are skeptical about this money. They consider them a soap bubble, noting that the value of bitcoins increases due to speculation, and its volume real use for trading does not change. Some financiers consider cryptocurrency transactions to be like a financial pyramid on a global scale.

Nevertheless, if something can be purchased for virtual currency, then it can be considered a means of payment to some extent. Thus, the German Ministry of Finance defined the status of bitcoin as a “unit of financial accounting”, that is, it recognized it as a type of money. In the United States, a federal court has ruled that BTC meets the concept of money.

Nevertheless, if something can be purchased for virtual currency, then it can be considered a means of payment to some extent. Thus, the German Ministry of Finance defined the status of bitcoin as a “unit of financial accounting”, that is, it recognized it as a type of money. In the United States, a federal court has ruled that BTC meets the concept of money.

The first ATM is already operating in Vancouver, Canada, where you can exchange bitcoins for the traditional national currency and vice versa. It is noteworthy that in the first week of operation of the exchanger, transactions were made in the amount of more than 100,000 Canadian dollars.

But in some states the new currency is not recognized. It is completely banned in Thailand. China, which used to be sympathetic to bitcoins, from 02/01/2014 banned financial institutions from any transactions with their participation. But such a ban was not introduced for individuals.

The Central Bank of France also spoke disapprovingly about the cryptocurrency. The regulator issued a press release calling the new currency a speculative and risky instrument. In Russia, bitcoins are called money surrogates. It sounded in official statement State Attorney General's Office. Representatives of the department said that the official currency Russian Federation- the ruble, and the use of monetary surrogates is prohibited by the current legislation of the country.

The reasons why financial regulators in individual countries do not consider virtual money as legal tender are obvious. This currency does not have an issuer, so there are no formal grounds for referring it to securities or banknotes. It is also difficult to call it a payment system, since there are no licensed operators that manage the turnover and bear legal responsibility.

The reasons why financial regulators in individual countries do not consider virtual money as legal tender are obvious. This currency does not have an issuer, so there are no formal grounds for referring it to securities or banknotes. It is also difficult to call it a payment system, since there are no licensed operators that manage the turnover and bear legal responsibility.

No financial institutions are involved in making payments in bitcoins. Payments are made directly and it is not possible to cancel the payment. Information about the payment made by the payer is distributed throughout the network and is accepted by all its other participants if the payment complies with the rules. Incorrectly made payment is rejected. Usually there is no commission when paying, but it can be voluntarily paid to expedite the processing of the transaction.

Addresses are anonymous and do not contain information about their owner. The address consists of text about 34 characters long. It includes numbers and letters of the Latin alphabet. Bitcoin addresses can be represented as QR codes, as well as other 2D barcodes that can be read mobile devices. A Bitcoin user can create multiple addresses on their own initiative.

Addresses are anonymous and do not contain information about their owner. The address consists of text about 34 characters long. It includes numbers and letters of the Latin alphabet. Bitcoin addresses can be represented as QR codes, as well as other 2D barcodes that can be read mobile devices. A Bitcoin user can create multiple addresses on their own initiative.

Acquiring a new address is all about creating a new key pair, and it doesn't even require a network connection. Obtaining an address for only one correspondent or for one transaction enhances anonymity. The storage of funds is the wallet file located on the computer. They can be transferred to any user using a Bitcoin address.

Based on the properties of the Bitcoin system, it is compared with gold. The Bitcoin resource is limited: the more bitcoins are mined, the more difficult further mining is. The resource cannot be copied; theoretically, the value of coins only increases over time. But virtual bitcoin is different from physical gold. You cannot buy something twice for the same coins. Cryptographic protection and the system algorithm will not allow this. The advantages of cryptocurrency, in comparison with gold, include the speed of transactions. The operation can be initiated even from a mobile phone, being at any distance from the recipient, the payment will be made in a few minutes.

Bitcoins are accepted as payment for hundreds of services and stores. There is an opinion that just as in due time Email limited the functioning of the traditional one to a minimum, and Skype pressed telephone companies, Bitcoin will be able to take its place in payment systems.

Perhaps virtual money will compete with the usual monetary circulation. The traditional currency has long become unsecured paper and is printed in any volume. Moreover, this process enriches some people and devalues the share of other owners of "candy wrappers", which are much more than the first. But it is still impossible to accurately predict the development of Bitcoin.

How is the price of bitcoin formed?

The course of BTC and other cryptocurrencies is formed on specialized exchanges, based on supply and demand, as it should be for any such asset. However, due to the rather low total capitalization of the currency, it is heavily influenced by big players and mass panic. This is clearly visible on the charts of cryptocurrency rates.

Bitcoin is absolutely not protected from speculation and is subject to strong volatility. For example, in 2013, its rate increased from $30 to $240 as a result of the banking crisis in Cyprus. Subsequently, quotes exceeded $1240. In total, in the incomplete year 2013, the exchange rate increased by 9500%. But in December, the bubble burst due to restrictive sanctions in China. The depreciation happened to $400. Since 2014, bitcoin has been steadily growing. In mid-February, the rate reached $620.

Almost every owner of several tens of thousands of military-technical cooperation can, using the general confusion and excitement around what is happening, collapse or raise the market. Local and global bitcoin pumps happen regularly and will happen as long as people are ready to buy and invest.

Almost every owner of several tens of thousands of military-technical cooperation can, using the general confusion and excitement around what is happening, collapse or raise the market. Local and global bitcoin pumps happen regularly and will happen as long as people are ready to buy and invest.

The BTC exchange rate, like any other currency, grows with an increase in demand. When players are ready to buy, it gradually rises. A sharp rise in the rate means not so much an explosive interest in the currency as the arrival of a pumper bull on the exchange.

Players with large assets (pumpers) can quickly buy sell orders and raise the rate to the maximum value in the shortest possible time. Pampers create the appearance of a stable growth in the exchange rate, provoking newcomers to buy. By dumping at the peak of activity, they dump their assets. The bitcoin exchange rate drops to the minimum values.

The popularization of the currency through advertisements and good news also causes the rise of the cryptocurrency. The more users are informed about the product, the more they will want to invest in it or play on the stock exchange. Bitcoin is advertised in all media mass media world, which contributes to the growth of its course.

Experienced traders are good at recognizing course changes such as correction, sinking and falling. A correction is a smooth increase or decrease in the exchange rate after a sharp fall or rise. However, if a correction in a certain period of time is observed on all exchanges with large trading volumes, this may mean that an instant drain is coming.

A drain is considered a sharp drop in the exchange rate by 15% or more. A drain is triggered by bad news, a dump, or a panic, much like China’s cryptocurrency restrictions. A drop means a medium-term moderate drain, as a result of which the price of military-technical cooperation decreases by no more than 5-7%.

Correction and rebound (a sharp short-term change in the price of bitcoin in the opposite direction) happen almost constantly. When playing on corrections and rebounds, the only serious problem is not knowing the minimum level of fall in the cryptocurrency rate (bottom) on which to buy.

Correction and rebound (a sharp short-term change in the price of bitcoin in the opposite direction) happen almost constantly. When playing on corrections and rebounds, the only serious problem is not knowing the minimum level of fall in the cryptocurrency rate (bottom) on which to buy.

A drain (dump) is an action planned in advance by large players, which is impossible to foresee, but theoretically can be anticipated. A long-term dump that lasts several days usually ends up being a drain. As a rule, the upcoming drain is foreshadowed by far-fetched negative news, escalation of the situation in chat rooms and the desire of pumpers to create a panic in the markets.

It is quite difficult to predict a fall or rise in the bitcoin rate without having serious assets. However, you can protect yourself from falling into a negative stream and avoid losing all your money. It is necessary to closely monitor the dynamics, trend and news. Constantly analyze the situation, not be afraid to make thoughtful decisions and even merge at a loss, but at the right time.

The cost of military-technical cooperation is not supported by any organization or government. Like other currencies, bitcoin is worth something, as people are willing to exchange it for services and goods. But its course is constantly fluctuating. Investing in bitcoins is quite risky. Early on, the system lacks widespread adoption and is therefore quite vulnerable.

Supporters of the system do not deny that no one promises money, the nominal value of which was provided and guaranteed by the state (fiat). The liquidity of the cryptocurrency is not guaranteed. Its non-speculative value is provided only by those goods or services that can be purchased for bitcoins, and does not depend on the global mass of commodities. The more people wish to use the new currency, the higher its rate will be.

Supporters of the system do not deny that no one promises money, the nominal value of which was provided and guaranteed by the state (fiat). The liquidity of the cryptocurrency is not guaranteed. Its non-speculative value is provided only by those goods or services that can be purchased for bitcoins, and does not depend on the global mass of commodities. The more people wish to use the new currency, the higher its rate will be.

Perhaps later, when bitcoin is more known, its stability may increase, but now the rate changes are quite unpredictable. Investing in cryptocurrencies should be carefully considered, and a clear risk management plan should be drawn up. The deflationary model of the military-technical cooperation itself assumes an increase in the exchange rate over time, but it is not guaranteed by anyone. Therefore, you should not invest in Bitcoin the last savings or amounts that are significant to you.

There are two options for investing in bitcoins. In the first case, money is simply invested in Bitcoin in the expectation of an increase in the rate. In the second, profit is obtained by speculating on fluctuations in the value of bitcoin. Bitcoin speculation can only bring income to players who understand trading. The rate of cryptocurrency is characterized by changes in the rate of tens and even hundreds of dollars a day. In the case of a correctly predicted movement of the exchange rate, the profit can be quite substantial.

There are two options for investing in bitcoins. In the first case, money is simply invested in Bitcoin in the expectation of an increase in the rate. In the second, profit is obtained by speculating on fluctuations in the value of bitcoin. Bitcoin speculation can only bring income to players who understand trading. The rate of cryptocurrency is characterized by changes in the rate of tens and even hundreds of dollars a day. In the case of a correctly predicted movement of the exchange rate, the profit can be quite substantial.

Prospects for Bitcoin

Many doubt the viability of Bitcoin. Much in the system is incomprehensible and resembles the famous financial pyramids. In fact, the developers of the program are unknown. There are various assumptions about who is hiding under the pseudonym Satoshi Nakamoto. The rules for issuing bitcoins gave clear advantages to the first users of the system.

In 2013, block generation required half a million times more operations than at the beginning of the system. The task becomes more difficult and requires much more resources and costs, while the value of the reward has decreased. Differences from the pyramids in the system, of course, are significant. Structures like MMM are based on a referral program. Profit is obtained only by inviting new members. Bitcoins are earned regardless of attracting fresh users. On the contrary, with an increase in the number of participants, mining becomes more difficult.

The number of participants in the Bitcoin network is relatively small, although it is the leader among cryptocurrencies. After a sharp rise in the price of bitcoins in 2011, other similar systems: Namecoin, Litecoin (LTC), Novacoin. But they have yet to achieve the popularity of Bitcoin. These currencies are traded relative to BTC and have the same rate changes. Many experts are distrustful of digital currencies and consider them a kind of pyramid scheme. Some suspect that these systems are "feeling for the way" to the creation of a new world currency, which should replace the dollar that has lost its credibility.

The number of participants in the Bitcoin network is relatively small, although it is the leader among cryptocurrencies. After a sharp rise in the price of bitcoins in 2011, other similar systems: Namecoin, Litecoin (LTC), Novacoin. But they have yet to achieve the popularity of Bitcoin. These currencies are traded relative to BTC and have the same rate changes. Many experts are distrustful of digital currencies and consider them a kind of pyramid scheme. Some suspect that these systems are "feeling for the way" to the creation of a new world currency, which should replace the dollar that has lost its credibility.

Despite the fact that the number of merchants willing to accept cryptocurrency is growing, its share in the global economy remains microscopic. This speaks of bitcoin more as a fashion trend than a real one. means of payment. It is possible that the number of virtual currencies in the near future may increase (there are already several dozen of them), but in the future there will be no more than three to five of them. Their courses will be extremely unstable, and the probability of recognition is small. Whether bitcoin will be among them is impossible to say today.

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Hosted at http://www.allbest.ru/

Introduction

Chapter 1. What is electronic money

Chapter 2. Varieties of virtual money

Chapter 3. Advantages of electronic money

Chapter 4. Disadvantages of electronic money

Chapter 5. Ways to use electronic money

Chapter 6. Electronic Wallets

Chapter 7. Problems of introducing virtual money

Chapter 8. Electronic money - a world without borders

Conclusion

Introduction

The Internet already has almost everything that a person may need. Goods, services, communication, self-expression, games, etc. Of course, you have to pay for some services, and the faster and easier system payments, the better. Both sellers and buyers began to feel the need for such a payment system. That is why electronic money was invented. Non-cash money was invented relatively recently. With their appearance, they made the same revolution that paper money caused in past centuries, which quickly replaced metal coins. Rapid development computer technology suggests that "electronic" non-cash money may soon displace cash altogether.

The task of any type of electronic money is to create a universal payment environment that unites buyers and sellers of goods and services. The purpose of electronic money is to increase the economic efficiency of the Internet as an industry as a whole. The mechanism of electronic money is such that it allows, without leaving the computer, to pay for goods, conclude transactions, and conduct commercial activities. Electronic money is very similar to electronic payment cards, only you do not have a card and a PIN code, but a login and password with which you can make money transactions. Also, at any time, you can withdraw money from the network or enter it into the network through a bank, postal order, cash, credit card, etc.

Chapter 1. What is electronic money

Electronic money is the monetary obligations of the issuer in electronic form, which are on electronic media at the user's disposal. Such monetary obligations meet the following three criteria:

· Recorded and stored on electronic media.

· Issued by the issuer upon receipt from other persons of funds in an amount not less than the issued monetary value.

· Accepted as a means of payment by organizations other than the issuer.

The term "electronic money" is relatively new and is often applied to a wide range of payment instruments that are based on innovative technical solutions. The consequence of this is the lack of a single, globally recognized definition of electronic money, which would unambiguously define their economic and legal essence.

Electronic money is characterized by an internal contradiction - on the one hand, they are a means of payment, on the other hand, the obligation of the issuer, which must be fulfilled in traditional non-electronic money. Such a paradox can be explained with the help of a historical analogy: at one time, banknotes were also considered as an obligation payable in coins or precious metals. Obviously, over time, electronic money will be one of the varieties of the form of money (coins, banknotes, non-cash money and electronic money). It is also obvious that in the future Central Banks will issue electronic money, just as now they mint coins and print banknotes.

A common misconception is the identification of electronic money with non-cash money.

Electronic money, being a non-personalized payment product, may have a separate circulation, different from the banking circulation of money, however, it can also be circulated in state or banking payment systems.

As a rule, the circulation of electronic money occurs with the help of computer networks, Internet, payment cards, electronic wallets and devices that work with payment cards (ATMs, POS-terminals, payment kiosks, etc.). Also, other payment instruments of various shapes are used: bracelets, key rings, blocks mobile phones etc., which have a special payment chip.

Electronic money fully simulates real money. At the same time, the issuing organization - the issuer - issues their electronic counterparts, called differently in different systems (for example, coupons). Further, they are bought by users who use them to pay for purchases, and then the seller redeems them from the issuer. When issuing, each monetary unit is certified by an electronic seal, which is checked by the issuing structure before redemption.

One of the features of physical money is its anonymity, that is, it does not indicate who used it and when. Some systems, by analogy, allow the customer to receive electronic cash in such a way that the relationship between him and the money cannot be determined. This is done using a blind signature scheme.

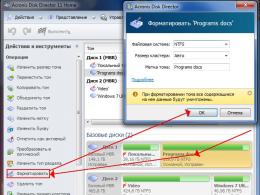

It is also worth noting that when using electronic money, there is no need for authentication, since the system is based on issuing money into circulation before using it. (see Figure 1. Payment with digital money).

Different systems offer different exchange schemes. Some open special accounts to which funds are transferred from the buyer's account in exchange for electronic banknotes. Some banks may issue electronic cash themselves. At the same time, it is issued only at the request of the client, with its subsequent transfer to the computer or card of this client and the withdrawal of the cash equivalent from his account. When implementing a blind signature, the buyer himself creates electronic banknotes, sends them to the bank, where, upon receipt real money they are stamped on the account and sent back to the client.

Figure 1. Payment with digital money

Chapter 2. Varieties of virtual money

Electronic money is usually divided into two types: based on smart cards (English card-based) and based on networks (English network-based). Both the first and second groups are divided into anonymous (non-personalized) systems, in which it is allowed to carry out operations without user identification and non-anonymous (personalized) systems requiring mandatory user identification.

Currently, smart cards issued by non-banking organizations and allowing payment transactions are quite widespread. These are telephone, transport, medical and other cards. However, most of them are single-purpose, that is, they allow you to pay for services (goods) only in favor of one company. As soon as it becomes possible to pay, for example, with a telephone card or public transport card for goods or services of other companies, for example, in a supermarket, such a payment instrument becomes electronic money.

It is also necessary to distinguish between electronic fiat money and electronic non-fiat money. Electronic fiat money is necessarily expressed in one of the state currencies and is a kind of monetary units of the payment system of one of the states. The state by law obliges all citizens to accept fiat money for payment. Accordingly, the emission, circulation and redemption of electronic fiat money takes place according to the rules of national legislation, Central Banks or other state regulators. Electronic non-fiat money - are electronic units of value of non-state payment systems. Accordingly, the emission, circulation and redemption (exchange for fiat money) of electronic non-fiat money occur according to the rules of non-state payment systems. The degree of control and regulation by government agencies of such payment systems in different countries differ considerably. Often, non-state payment systems tie their electronic non-fiat money to the rates of world currencies, but the states do not ensure the reliability and real value of such units of value. Electronic non-fiat money is a type of credit money.

One of the most common mistakes is referring to electronic money. modern means access to a bank account, namely, traditional bank payment cards (both microprocessor and magnetic stripe), as well as Internet banking. In systems that carry out settlements with electronic money, bank accounts are used only when entering and withdrawing money from the system. In this case, the consolidated bank account of the issuer of electronic money is used, and not card or current accounts of users. When issuing electronic money, traditional money is credited to the consolidated bank account of the issuer. When electronic money is presented for redemption, traditional money is debited from the issuer's consolidated bank account.

One more typical mistake refers to electronic money prepaid single-purpose cards, such as: gift card, fuel card, telephone card, etc. The use of such a payment instrument does not mean the implementation of a new payment. The real payment is made at the time of purchase or replenishment of such a card. Its use does not generate new cash flows and is a simple exchange of information about consumed goods or services.

Chapter 3. Advantages of electronic money

Electronic money is especially useful and convenient when making mass payments of small amounts. For example, when paying in transport, cinemas, clubs, paying utility bills, paying various fines, making payments on the Internet, etc. The process of paying with electronic money is fast, there are no queues, there is no need to give change, money is transferred from the payer to the recipient quickly .

Electronic money is most correctly compared with cash, since the circulation of non-cash money is necessarily personified and the details of both parties are known. In the case of payments by electronic money, it is enough to know the details of the recipient of the money.

Electronic money has the following advantages over cash:

· excellent divisibility and combineability - when making a payment, there is no need for change;

high portability - the value of the amount is not related to the overall or weight dimensions of money, as is the case with cash;

· very low cost emission of electronic money - no need to mint coins and print banknotes, use metals, paper, paints, etc.;

no need to physically count the money, this function is transferred to the storage instrument or payment instrument;

· it is easier than in the case of cash to organize the physical protection of electronic money;

the moment of payment is fixed electronic systems, the impact of the human factor is reduced;

· when paying through a fiscalized acquiring device, it is impossible for a merchant to hide funds from taxation;

· electronic money does not need to be counted, packaged, transported and organized in special storage facilities;

· ideal persistence - electronic money does not lose its qualities over time;

· perfect qualitative homogeneity - individual copies of electronic money do not have unique properties (such as scratches on coins);

· security - protection from theft, counterfeiting, denomination changes, etc., is provided by cryptographic and electronic means.

Chapter 4. Disadvantages of electronic money

· lack of well-established legal regulation - many states have not yet decided on their unambiguous attitude to electronic money;

· despite excellent portability, electronic money needs special storage and circulation tools;

· as in the case of cash, when the electronic money carrier is physically destroyed, it is impossible to restore the monetary value to the owner;

no recognition - no special electronic devices one cannot easily and quickly determine what kind of object, amount, etc. it is;

Impossibility of direct transfer of part of the money from one payer to another;

· facilities cryptographic protection, by which electronic money systems are protected, do not yet have a long history of successful operation;

· theoretically, interested parties may try to track the personal data of payers and the circulation of electronic money outside the banking system;

· security (protection against theft, forgery, denomination change, etc.) - not confirmed by wide circulation and unproblematic history;

· Theft of electronic money is theoretically possible, using innovative methods, using insufficient maturity of protection technologies.

Chapter 5. Ways to use electronic money

Plastic cards and their types

A plastic card is a general term that refers to all types of cards that differ in purpose, in the set of services provided with their help, in their technical capabilities and organizations.

A plastic card is a plate of standard sizes (85.6 mm 53.9 mm 0.76 mm) made of a special plastic that is resistant to mechanical and thermal influences. One of the main functions of a plastic card is to ensure the identification of the person using it as a subject of the payment system. To do this, the logos of the issuing bank and the payment system serving the card, the name of the cardholder, his account number, the expiration date of the card, etc. are applied to the plastic card. In addition, the card may contain a photograph of the holder and his signature. Alphanumeric data - name, account number, etc. - can be embossed, i.e. printed in embossed type. This makes it possible, when manually processing cards accepted for payment, to quickly transfer data to a check using a special device, an imprinter, which "rolls" the card (in exactly the same way as a second copy is obtained when using carbon paper).

The graphical data enables visual identification of the card. Cards, the service of which is based on this principle, can be successfully used in small local systems- as club cards, store cards, etc. However, for use in the banking payment system, visual "processing" is clearly not enough. It seems appropriate to store the data on the card in a form that ensures the automatic authorization procedure. This problem can be solved using various physical mechanisms.

On cards with a barcode as an identifying element, a bar code is used, similar to the code used for labeling goods. Typically, the code strip is covered with an opaque compound, and the code is read in infrared rays. Barcode cards are very cheap and relatively easy to manufacture compared to other types of cards. The latter feature causes their weak protection against forgery and therefore makes them unsuitable for use in payment systems.

Magnetic stripe cards are by far the most common - there are over two billion cards of this type in circulation. The magnetic strip is located on reverse side cards and, according to the ISO 7811 standard, consists of three tracks. Of these, the first two are designed to store identification data, and the third can record information (for example, the current value of the debit card limit). However, due to the low reliability of the repeatedly repeated writing/reading process, recording on a magnetic stripe, as a rule, is not practiced, and such cards are used only in the information reading mode. The security of magnetic stripe cards is significantly higher than that of barcode cards. However, this type of card is also relatively vulnerable to fraud. Thus, in the United States in 1992, the total damage from fraud with magnetic stripe credit cards (excluding losses with bank machines) exceeded one billion dollars. Nevertheless, the developed infrastructure of existing payment systems and, first of all, the world leaders in the "card" business - VISA and MasterCard / Europay companies is the reason for the intensive use of magnetic stripe cards today. Note that to increase the security of VISA and MasterCard/Europay cards, additional graphic aids protection: holograms and non-standard fonts for embossing.

On the front side of a card with a magnetic stripe, it is usually indicated: the logo of the issuing bank, the logo of the payment system, the card number (the first 6 digits are the bank code, the next 9 are the bank card number, the last digit is the control, the last four digits are printed on the hologram), the term card actions, cardholder's name; on the reverse side- magnetic stripe, place for signature.

In smart cards the information carrier is already a microcircuit. For the simplest existing smart cards - memory cards - the amount of memory can be from 32 bytes to 16 kilobytes. This memory can be implemented either in the form of EPROM (EPROM), which allows one-time write and multiple reading, or in the form of EEPROM (EEPROM), which allows both multiple reading and multiple writing. Memory cards are divided into two types: with unprotected (fully accessible) and protected memory. In the cards of the first type, there are no restrictions on reading and writing data. The availability of all memory makes them convenient for modeling arbitrary data structures, which is important in some applications. Secure memory cards have an identification data area and one or more application areas. The identification area of the cards allows only a single entry during personalization, and in the future is available only for reading. Access to application areas is regulated and carried out upon presentation of the corresponding key. The level of protection of memory cards is higher than that of magnetic cards, and they can be used in applied systems where the financial risks associated with fraud are relatively low. As for the cost of memory cards, they are more expensive than magnetic cards. Recently, however, their prices have declined significantly due to the improvement of technology and growth in production volumes. The cost of a memory card directly depends on the cost of the microcircuit, which in turn is determined by the memory capacity.

A special case of memory cards are counter cards, in which the value stored in memory can only change by a fixed amount. Such cards are used in specialized prepaid applications (payment for the use of a pay phone, payment for parking, etc.)

Microprocessor cards are, in fact, microcomputers and contain all the relevant main hardware components: the central processing unit, RAM, ROM, PROM, EEPROM. The parameters of the most powerful modern microprocessor cards are comparable to those of personal computers early eighties. Operating system, stored in the ROM of the microprocessor card, is fundamentally no different from the PC operating system and provides a large set of service operations and security features. Operating system supports file system, based in EEPROM (the capacity of which is usually in the range of 1 - 8 KB, but can be up to 64 KB) and provides data access regulation. In this case, part of the data can only be accessed internal programs cards that, together with the built-in cryptographic means makes the microprocessor card a highly secure tool that can be used in financial applications that place high demands on information security. That is why microprocessor cards (and smart cards in general) are currently considered the most promising type. plastic cards. In addition, smart cards are the most promising type of plastic cards also in terms of functionality. The computing capabilities of smart cards make it possible to use, for example, the same card both in transactions with on-line authorization and as a multi-currency online wallet. Their widespread use in VISA and Europay/MasterCard systems will begin in the next year or two, and within a decade, smart cards should completely replace magnetic stripe cards (at least, those are the plans...).

In addition to the types of plastic cards described above used in financial applications, there are a number of cards based on other data storage mechanisms. Such cards (optical, induction, etc.) are used in medical systems, security systems, etc.

Chapter 6. Electronic Wallets

electronic money plastic card

A program installed on a computer and used to store electronic cash and make payments with them is called a wallet. The payment system (more about the PS - in section 6) "PayCash" also operates with the concept of an account - your account contains money that you deposited into the system, but have not yet been exchanged for electronic cash.

The current legal mechanisms allow various payment systems to work within the framework of the current Russian legislation. All electronic payment systems are based on the use of either payment cards or " e-wallet(or wallet). If there is a Regulation of the Bank of Russia No. 23-P dated April 9, 1998 “On the procedure for issuing bank cards by credit institutions and making settlements for transactions made using them”, which sets out the mechanism for card payments, then wallets should be discussed in more detail .

It is desirable to put something in this wallet. Well, what is a wallet without money?! Naturally, money will lie there - this is precisely the very serious misconception that led to the circulation of the term "electronic money". Not money is placed in an electronic wallet, but only their electronic value. The money remained in the bank or in the company that issued this wallet. After all, no one will argue that a telephone card or a magnetic metro ticket are money. Everyone understands perfectly well that this is only a means to use certain services. And these mechanisms allow you to use prepaid services. The same is true with an electronic wallet. It should be considered as a prepaid financial product. Moreover, it is in this form that our legislation gives it the right to exist. Bank of Russia Ordinance No. 277-U, dated July 3, 1998, “On the Procedure for Issuing Registration Certificates to Resident Credit Institutions for Issuing Prepaid Financial Products”.

In such cases, we should talk about electronic payments or electronic value as the electronic equivalent of ordinary money placed on a payment card or in an electronic wallet on a computer hard drive.

The electronic value is still tied to the account, regardless of whether it is a bank account or similar services are provided by a non-bank organization. Funds are placed on this account, and the client is transferred to the card or electronic wallet the equivalent electronic value of these funds, and then he uses them for his intended purpose. Moreover, when making calculations or, more precisely, transferring the electronic value, the movement of the funds themselves does not occur. Real money is either exchanged for electronic value, at the time of its presentation, collected by the seller for goods or services sold, or a kind of clearing of transactions occurs in which electronic value is involved.

Everything Russian systems electronic payments necessarily use bank accounts. And already from this account, the electronic value is transferred, first to the buyer's wallet, and then to the seller for the purchased goods. Money still remains in bank accounts and banks make settlements for their customers.

Digital money, which is just some information, can be stored on any storage medium, in particular, on the hard drive of a desktop computer or laptop, floppy disk, smart card, which at the same time turn into an electronic wallet.

New technical development in this area is Dai Nippon Printing Co Ltd's planned mass production in May 2004 of the "wallet of the future" - a compact device for electronic money and tickets. The device measures 6.2 x 3.2 x 1.7 cm, weighs 20 g, and is in fact a miniature computer with 16-bit central processing unit and a four-line black and white LCD screen that allows you to make payments and check your balance via the Internet. The device can work with different SIM-cards. The expected price of the device is from 50 to 100 USD and it is planned to release 1 million units during this year.

Chapter 7. Problems of introducing virtual money

The central banks of most countries are very wary of the development of electronic money, fearing uncontrolled emission and other possible abuses; although electronic cash can provide a host of benefits, such as speed and ease of use, greater security, lower transaction fees, new business opportunities with the transfer of economic activity to the Internet. There are many controversial issues regarding the introduction of electronic money. The introduction of electronic currencies raises a number of issues, such as fundamentally unresolved problems in collecting taxes, ensuring emission, the lack of standards for ensuring the emission and circulation of electronic non-fiat money, and concerns about the use of electronic payment systems for money laundering.

Quite complex technologies are used for the circulation of electronic money, and commercial banks are not always willing and able to independently develop new products.

The main reasons for the reluctance of banks to develop projects related to electronic money are:

· the need to finance developments, the fruits of which can be used by competitors;

· Difficulties in cooperation with other banks in order to share the costs of innovative developments;

Cannibalization of already existing banking products with new ones;

lack of qualified specialists in their own staff;

Uncertainty about the reliability of outsourcers.

Against the backdrop of problems with the implementation of "electronic money" projects by commercial banks, a lot of small projects and start-ups appear on the market, the main problems of which are this moment are:

· extremely small size of the real market of "electronic money";

· Priority focus of legislation in the field of payment systems on the banking industry;

· Regulators' unwillingness to let non-bank companies into the payment systems market;

· a large number of competing and poorly oriented technologies and lack of standards.

Obviously, the problems of the new "electronic money" market can be solved by a long evolutionary path or with the help of large infrastructure projects initiated by states (for example, the Russian National System of Payment Cards or the Ukrainian NSMEP).

Chapter 8. Electronic money - a world without borders

A multi-level system will make it easy to send money from a village in the wilds of Paraguay to a Siberian village, will allow you to establish financial connections between any people on Earth, wherever they are, will turn all Humanity into a single financial society.

The world opened for money will become open for people, for goods, for ideas, for any communication. It is electronic money that will fulfill the age-old dream of Mankind about uniting people. It is electronic money that will eliminate all borders, turn borders into cartographic concepts, and then, perhaps, eliminate them altogether.

A person will be able to freely go to any point on the Earth with just one card in his pocket and find food and shelter, entertainment and everything he needs, of course, if there is money on this card, more precisely, on a bank account that is controlled by a card. . Just money. Not American or Japanese money. And in the future, one can imagine that the card itself will not be required, the bank account number can be written on the palm of an invisible and indelible paint, identification of a person and his account will be carried out by a papillary pattern on his finger.

It can be assumed that no passports and registrations will be needed, the bank account number will become the only identifier of a person's identity, and the identifier is unique, the only identifier from birth to death and even after death.

All of it Bank operations- his purchases, receipts and other financial movements for a certain time can be stored in the bank.

Thus, in the 21st century the world is entering the era of not a legal, but a financial society. It will no longer be a right to control the behavior of an individual, which you need to know, you need to understand, you need to read and remember something somewhere. In the era of electronic money, most violations will simply be impossible simply because a computer will not let them through. If drugs are prohibited, then you cannot buy them simply because the computer will not miss the payment from individual drug manufacturer. If it is forbidden for private individuals to purchase some dangerous products - radioactive substances, poisons, weapons, etc., then an individual will not be able to purchase them, because the payment from an individual to manufacturing enterprises or suppliers will simply be blocked in the bank computer. And that which cannot be paid for, cannot be possessed. Of course, some master can make a scarecrow for himself, but it is clear that such "crime" does not threaten society in any way, just as a dozen boys running through the subway without a coin do not pose any danger or financial damage to the subway. So small crime is not at all dangerous to society, rather it is even useful, the main thing is that there are no opportunities for mass crime, it will be eliminated by electronic money.

So, electronic money is a society of freedom, a society in which a person is free to move around the world - not only a white person from North America and Western Europe, but any person on Earth. This is a society of truly equal people in the sense that the limits of behavior are set, in fact, by a computer that cannot be bribed or appeased, that is not capable of making any distinctions between people - be it a janitor or a president, where your rights do not depend on an official, which may or may not allow. Everything is extremely simple here. computer program forbids this action - it will be forbidden, and any pleas, "approaches" and bribes are powerless to persuade him. So we really see that the idea of a rule of law is the yesterday of human civilization, the 21st century is not the century of law, but the century of financial regulation of human behavior through soulless universal unified algorithms, financial prohibition, creating the widest scope for permissible actions. This is the kind of freedom in front of which the freedoms of a rule of law state will seem like real slavery and bureaucratic despotism. A person feels offended if he knows that he can, but it is impossible, since a person or a circular forbid. And he cannot be offended by a car, no one is offended by a turnstile in the subway, which does not let him through without a token. Such is the difference between legal (juridical) and financial social arrangements.

Conclusion

So, it is clear that electronic money is a very flexible tool that allows you to expand the scope of cash. With their help, it is also easy to lend money to a friend (and at a distance) and use it in everyday "non-electronic" life, as well as pay for a purchase on the Internet or set up your own business there.

Only Electronic money can provide micropayments - so necessary for the information business and the sale of publications. Such electronic money may be marked for special use(only for movies, for example), which is very convenient for controlling money in the family.

The cost of a transaction using electronic money and its processing and accounting is much cheaper than the cost of processing traditional money, credit cards and checks and other means of payment. The processing of electronic money is easier, and its use can seriously change the structure of banks and reduce staff.

Electronic money, unlike check and credit systems, allows you to maintain the anonymity of transactions (to one degree or another), since they do not require identification of the payer and his creditworthiness when using them.

Unlike traditional cash, payment with electronic money does not require the presence of the payer and the recipient, since the transfer can be done remotely via the Internet or by phone.

Bibliography:

1) http://www.money.ru/publish/s05.htm

2) http://www.3dnews.ru

3) http://ru.wikipedia.org/wiki/Electronic_money

Hosted on Allbest.ru

Similar Documents

Legal and economic essence of electronic money. Blind signature scheme. Payments with digital money. The main advantages of using plastic cards. Types of electronic money and ways to protect them. Money emission and control over it.

term paper, added 09/24/2011

The essence of electronic money. The history of the development of electronic money. Types of electronic money. Electronic money in the economy. Ways to use electronic money. Gold in the digital money system. Prospects for the development of electronic money.

term paper, added 05/09/2003

The function of money as a measure of value, means of circulation and accumulation, payment and world money. Commodity origin of money. Metal ingots of exact weight and quasi-money. Classification and nature of electronic money. Payment system in WebMoney Transfer.

term paper, added 12/02/2012

The essence and functions of the monetary system. The emergence and development of money. Electronic money is an important component of the modern economy. Definition of electronic money and electronic payment systems. Problems of implementation and prospects for the development of electronic money.

term paper, added 12/06/2009

Electronic money is the simplest and fastest form of payment. Circulation of electronic money using computer networks, the Internet, payment cards, electronic wallets. Classification and advantages of electronic money. Multilevel protection of banks.

term paper, added 11/24/2010

The concept and main functions of money as a measure of value, as a means of accumulation, savings and payment. Characteristics of the types of modern money and features of their use. Stages of evolution of money in Russia and in the world, ways and directions of their improvement.

term paper, added 10/04/2010

Short story money. The inevitability of existence. Types of money. Natural (material) money. symbolic money. Functions of money. The measure of value. Means of accumulation, circulation, payment. Inflation, its causes and consequences. Lack of money. Barter.

abstract, added 04/24/2003

The concept of money, their meaning, types, functions and participants in relations. Analysis of the functioning and use of credit types of money in the Russian Federation. Problems of Russian legislation regulating monetary circulation. Prospects for the development of electronic money in Russia.

thesis, added 02/07/2012

The history of the emergence of money, their essence, functions. Money as a measure of value, a means of accumulation, circulation, payment. What is world money. money theories, monetary systems, the law of money circulation. Varieties of money, features of the exchange rate.

term paper, added 05/03/2010

Properties of electronic money, the possibility of using electronic means of payment. Issue of electronic money, their advantages and disadvantages. The history of the emergence and development of electronic money, the legislative framework governing their use in Russia.